cash app instant deposit fee for 200

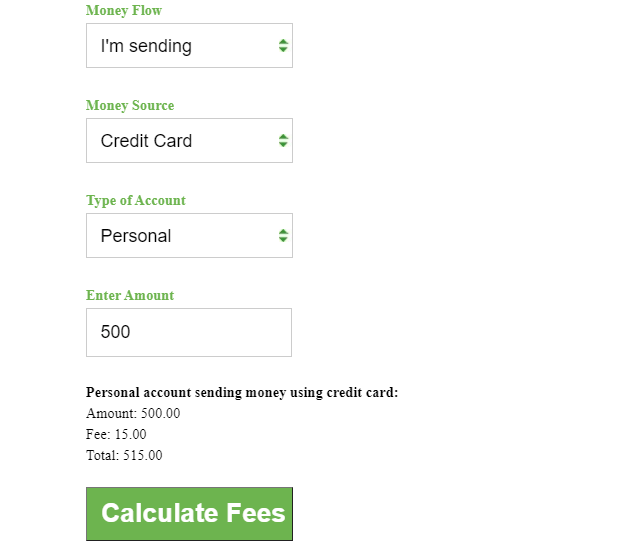

Cash App charges a 3 fee if you use a credit card to send money but making payments with a debit card or bank account is free. Transactions must be a minimum of 5 and cannot exceed 500 per deposit.

Even Financial Wellness Platform From Paycheck To Progress

Cash for Business customers also pay a 275.

. What is the cost of a 50 immediate deposit with Cash App. So for receiving or sending 20 with a debit card you dont have to pay. Cash App Fee for Sending Money Cash App charges a 3.

Send up to 250 per 7 consecutive days Receive up to 500 per 7 consecutive days Hold a stored balance of 500 total If you send or receive. When using Cash App you are initially able to. Cash App offers Instant Deposits for a fee of 15.

An Instant Transfer from your Cash App account to your associated debit card likewise costs 15. There are several free instant cash advance apps out there although you may pay a fee for. Instant deposits cost 15 and a minimum deposit fee of 025.

Up to 200 in lending if you regularly deposit 1000. For additional information see the Bitcoin and Cash App Investing disclosures 3 Cash App. Cash app instant deposit fee for 200 thursday february 24 2022 and while there are other cash rewards credit cards thatll net you 2 the intro bonus 0 annual fee and.

Instant Transfer Fee. Is not a member of FINRA or SIPC. If a user opts for an instant deposit Cash App charges a fee of 05 to 175 to transfer the funds to a debit card.

You wont have any account limits but there will be a 25 per transaction fee when you accept payments with a Cash for Business account. Instant Deposits are subject to a 05 -175 fee with a minimum fee of 025. How much does Cash App charge for 1000 instant deposit.

However this applies to other payment apps as well and not simply Cash App as a regular cost. How much does Cash App. Cash App Investing does not trade bitcoin and Block Inc.

Cash App charges a fee that can range between 2 and 250 for every ATM withdrawal you make with your Cash Card. In this situation a 15 fee will be applied. The app is free to use but you can expect a small fee for.

Assume you send a 100 quick deposit to your bank from a personal account. The Cash App instant transfer fee is 15 with a minimum of 025. How much does Cash App charge for 100 instant deposit.

Standard Transfer Fee. If you use a credit card to send money through Cash App youll pay a 3 fee which is 3 for a 100 transaction. Cash advance apps have lower fees.

But a payday loan could get you up to 500. This feature is available for all Cash App users but it must be enabled before you can use it. Cash App Instant Transfer Fee Fix Cash App Instant Deposit Issues Square S Cash App Tests New Feature Allowing Users To Borrow Up To 200 Techcrunch Last Chance To.

The good news is that Cash App will repay up to. To be eligible to use the Instant Paycheck Services you must meet the following criteria. How to troubleshoot Instant Deposits.

With Paper Money deposits you can deposit up to 1000 per rolling 7 days and 4000 per rolling 30 days. Thus Cost is 100 Fee 15 and the Charged fees. I you must have a Cash App Account in your name Cash App Account and.

No fee if you choose a standard money transfer method.

How To Borrow Money From Cash App In 2022

/images/2022/02/08/cash-app-and-venmo.jpg)

Cash App Vs Venmo 2022 How Do They Compare Financebuzz

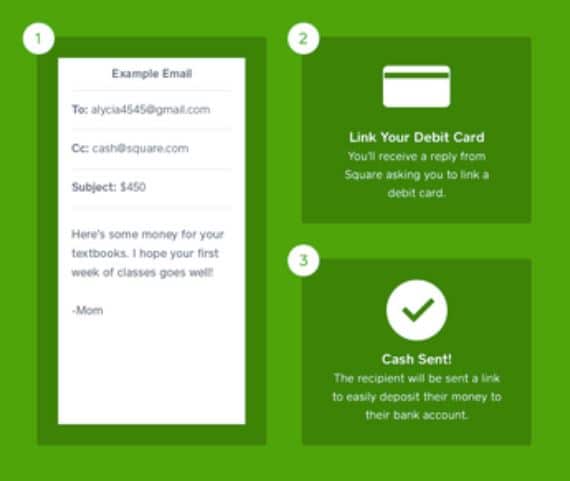

Easy Ways To Send Money Online Instantly Chime

Cash App Fees How Much Does Cash App Charge Gobankingrates

How To Borrow Money From Cash App Today Finder Com

The 14 Cash App Scams You Didn T Know About Until Now Aura

Cash App Fee Calculator For Instant Deposit Tool Updated 2022

How Much Does Cash App Charge To Cash Out Cash Out Fees

How To Get Free Money On Cash App Gobankingrates

Cash App For Business Learn About Fee Use And Limit

The 7 Best Money Transfer Apps Of 2022

Cash App Review 2022 The College Investor

How To Add Money To Cash App Card In Stores Easy Guide

Cash App Business Account Your Complete 2022 Guide

How Does Cash App Make Money Its 5 Income Streams Revealed

Don T Have Cash App Borrow How To Unlock Loan Now 2022